To a landlord, a tenant’s ability to pay their agreed-upon rent on time is the most crucial of the rental relationship. The ultimate concern for any landlord is dealing with a bad tenant that may need to be evicted from their property, and failure to pay rent will lead to this.

Between eviction court costs, the cost of a lawyer, and final legal fees, it is safe to say at the bare minimum, a landlord could be looking at nearly $1,000 out of pocket, with the potential for this cost to reach $3,000. After this frustrating and time-consuming task, it’s also uncertain if recouping any of these eviction costs from the tenant, if successful, is a reality.

So, how do you avoid the headaches of evicting tenants and high tenant turnover? It starts with effectively screening your tenants to give yourself the best shot possible in the tenant-landlord relationship.-+

What Is A ResidentScore?

A ResidentScore is a score specifically built to give insight into the outcome of a lease. The score was created by TransUnion after compiling nationwide credit data from individuals that led to negative rental outcomes.

TransUnion took this data and combined it with demographic, and eviction characteristics to create the ResidentScore model, predicting high-risk outcomes for the rental industry.

ResidentScore vs. Credit Score: What You Need To Know

Going into a landlord-tenant relationship, the more rental industry-tailored relevant data you have on a tenant the better. This will lead to a reduction in unnecessary risk and can easily display red flags a potential tenant might bring to your entity.

According to a TransUnion survey, 84% of independent landlords ranked “payment problems” as their top concern.

Below, we discuss the differences between a ResidentScore and a credit score and the benefits of implementing this score into your tenant screening practices, including helping out with missed tenant payments.

Credit Score

The common practice score that landlords have turned to gauge a prospective tenant’s financial stability has always been the credit score. However, recently, SmartMove, introduced the ResidentScore. A score that aims to more accurately assess the risk a prospective tenant may have on a landlord.

What is factored into a credit score?

In its simplest form, a credit score is a tool used to determine how likely someone can pay back a loan. A credit score analyzes these factors:

- Payment History

- Total Debt Owed

- Length of credit history

- New or recent credit

- Types of credit

The credit score will fall in a range from 300 up to 850. Where the number falls represents what type of credit risk you carry for lenders.

Variations Of Credit Scores

Many different variations of credit scores are used throughout different industries. A FICO credit score and VantageScore are two of the most common, displaying a general overview of how long you’ve had credit, how much credit you have, how much of your available credit is being used, and if you’ve paid on time.

Although effective reports, these scoring models are not built for the rental screening industry and focus more on the financial services industry such as credit cards and auto loans.

ResidentScore

According to TransUnion, the ResidentScore was created after analyzing 2.9 million residents with payment history taken into account while identifying the key pieces of credit data that lead to evictions. The model uses a 12-month lease term looking to uncover instances of evictions, 3+ late payments, and insufficient funds.

What’s factored into a ResidentScore?

The TransUnion SmartMove Report’s ResidentScore looks at the below factors to assess the risk a prospective tenant may have on a rental relationship.

- Positive and negative payment history for lines of credit.

- Usage of credit – the amount of credit being used by the individual.

- Credit history – the types of accounts and length of credit history

- Credit availability – the available credit limits

- Inquiry history – the information related to the individual seeking new credit

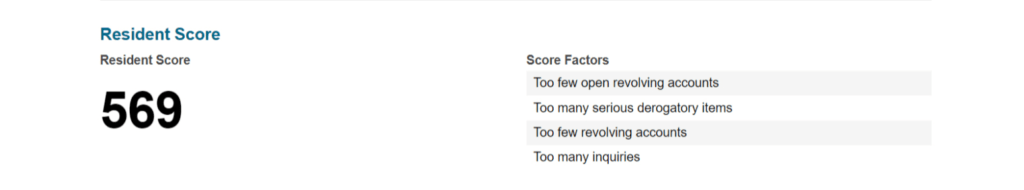

Once the ResidentScore is generated on the prospective tenant, the TransUnion resident score range is generated, this is a numerical value that is assigned ranging from 350 to 850, along with a factor recommendation on why the resident received that score.

What is a good TransUnion resident score?

A good TransUnion Resident Score that you can have confidence in ranges from 538 to 850.

The SmartMove includes this within it. Here is a look at the TransUnion resident score range:

Decline: 350 – 523

Conditional: 524-537

Low Accept: 538-559

Accept: 560- 850

The ResidentScore report also provides a list of score factors that impacted the numerical value assigned along with a detailed report exploring the prospective tenant’s history.

How to check my TransUnion resident score?

To locate the resident score on your SmartMove, open your report, and scroll down one fold, the ResidentScore will be located directly below the “Profile Summary” section.

The Importance Of ResidentScore To Landlords Everywhere

When utilizing a ResidentScore as opposed to just a credit score, you are able to free yourself from solely basing decisions based on the algorithms and scoring models that banks use.

Your score has active insight into the probabilities of a bad rental outcome. TransUnion states that the ResidentScore Identifies 15% more evictions and 19% more skips than other typical credit scores.

Remember, the first step of the process to make being a landlord that much easier is finding good tenants. Tenant screening is your first stop on that roadmap and utilizing an effective tenant screening solution that gives you the most data possible has proven to minimize the financial risk a tenant may bring to your business.

The Landlord-Tenant Relationship In 2022: Mitigating Risk

In mitigating your risk and finding a tenant that will make being a landlord a valuable experience for you, it is important to gather the most data when sourcing prospective tenants before making a decision. Having a sound tenant screening plan allows you to get out in front of any potential future that may arise throughout the rental relationship.

Understanding the financial risk a new tenant can bring is the first step in the process, uncovering how responsible that tenant may be in the future. You can gain a general insight into your tenant’s financial behavior and habits from a credit score, however, a more defined perspective can be gained by referencing a ResidentScore.