Updated May 2022

Choosing a tenant background check service is not an easy task. Different screening options offer different levels of service, and the differences between the options that exist are not always obvious. But don’t worry; RentPrep has you covered with our tenant background check services reviews.

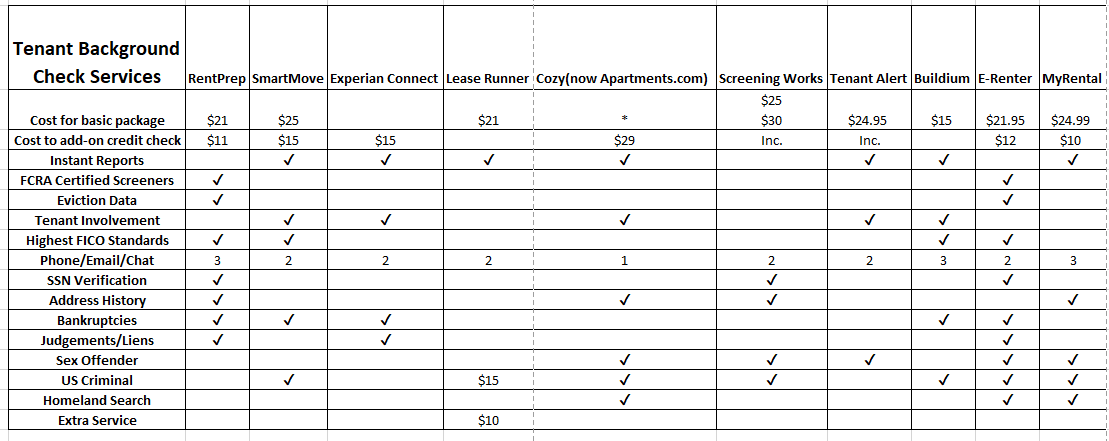

Below, we’ve compiled a list of the 11 largest tenant background check services for landlords. And we’ve also included pricing for each tenant screening service. We then broke each service down by the services offered in their basic package to help you draw your own conclusions about each service.

Finally, today’s article will give landlords like you the answers to all of the FAQs that come up when you’re dealing with tenant background checks, screening services, and related areas. Finding reliable information about these things can be difficult, but we’re committed to helping you get what you need.

Table Of Contents For Tenant Background Check Services Reviews

- What To Know Before Reviewing Tenant Screening Services

- The 11 Tenant Background Check Services Reviews In This Guide

- Comparing Customer Service Of Screening Services

- Top 11 Tenant Background Search Reviews

- How To Use This Data To Select A Tenant Screening Service

- Other Tenant Background Check Services Worth Mentioning

- What Is The Best Background Check For Landlords?

- FAQs About Tenant Background Check Reviews

What To Know Before Reviewing Tenant Screening Services

There are three topics we want to quickly address before jumping into the comparison chart below.

- The difference between a background report and a credit report

- The one piece of data that will reveal an applicant to be over 2.5 times higher risk for eviction

- Understanding the entire screening process

We created a quick video to cover these three topics.

For easy reference, here’s a link to the free tenant screening course mentioned in the video above.

If you’re not a Udemy user, you can check out our tenant screening guide on our website for easy reference.

You’ll also want to read up on what’s included with a rental background check if you’re not sure of the importance of various aspects mentioned below.

Take a look at the chart (below) for a review of each tenant screening service based on their basic service.

The 11 Tenant Background Check Service Reviews In This Guide

- RentPrep

- TransUnion SmartMove

- Experian Connect

- Lease Runner

- Cozy (Now Apartment.com)

- Screening Works

- Tenant Alert

- Buildium

- E-renter

- Tenatify

- MyRental

Note: This list is for services specific to the United States. If you’re looking for international property management tools (United Kingdom & New Zealand) we recommend Landlord Studio.

Legend:

This is a quick synopsis of what each feature in the left-hand column represents.

- Cost for the basic package – Each service offers tiered packages and we selected the basic package to establish a baseline package to compare across the board.

- The cost to add-on credit check – The cost of credit check services for landlords or report for each service.

- Instant Reports – Does the service provide a tenant report immediately?

- FCRA Certified Screeners – Does the service employ FCRA screeners to run background reports?

- Eviction Data All 50 States – Does the basic package include eviction history for all 50 states?

- Tenant Involvement – Does the service require tenant involvement?

- Highest FICO Standards – Does the service use the highest FICO standards for their reports?

- Phone/Email/Chat – Does the service offer customer support using 1, 2, or 3 of these services?

- SSN Verification – Is a manual SSN verification performed?

- Address History – Is tenant address history provided?

- Bankruptcies – Are bankruptcies included?

- Judgments/Liens – Are they included on the report?

- Sex Offender – Does the basic package include this service?

- US Criminal – Is a national criminal search performed?

- Homeland Search – Also called terrorist search

- Extra Services – Will be explained for each service with a mention

– Indicates the service is provided within the basic package (according to website data as of December 2016)

* Denotes a special circumstance which will be explained in that service’s breakdown.

** Will be explained further down in the post.

NOTE: Eviction/Criminal Data All 50 States – Any instant reporting service cannot access all criminal history. This is because certain states (Massachusetts, Delaware, South Dakota, Wyoming, and most recently Colorado) require you to manually search records and won’t allow software to access their data. For eviction history, most instant searches are using the national eviction database, which is known to be incomplete.

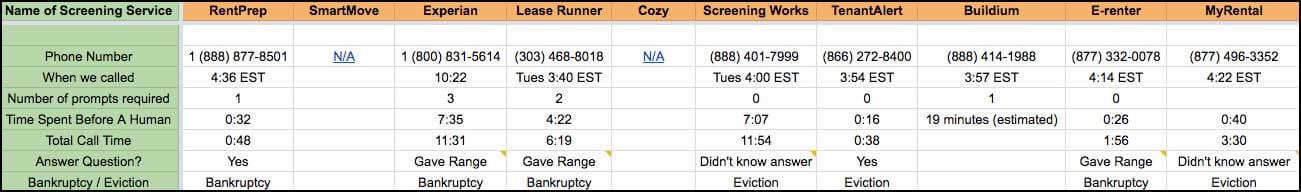

Comparing Customer Service Of Screening Services

We wanted to also conduct a test comparing the services of each from a customer support angle.

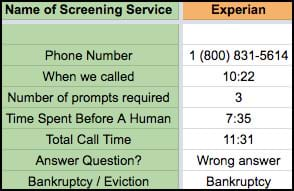

Below is a table of our findings that you can click to open up in a separate window to see the results.

We called each service that has a phone number listed on their site.

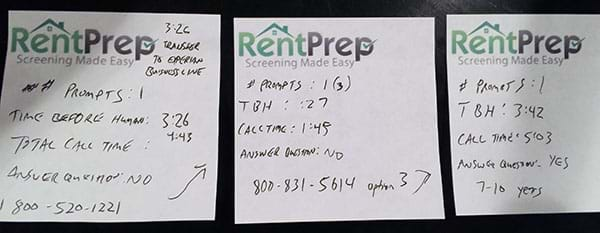

Here’s a live example (using RentPrep) of the call we made to each service asking them how long a bankruptcy or eviction is reportable for…

If you click the SmartMove and Cozy customer support links on their site, you’ll see there are no phone numbers listed.

This is common for very large services to funnel their customer support into a ticket-based system.

For the remaining services that listed a phone number, we asked a simple question, “How long is a bankruptcy reportable for?”

A bankruptcy is reportable for 10 years according to the rules of the FCRA (Fair Credit Reporting Act).

In some instances, the service did not offer bankruptcy information in their reports, so we asked, “How long is a tenant eviction reportable for?”

Again, this question is simple, and the answer is that an eviction is reportable for seven years.

Results From This Test

RentPrep and TenantAlert were the only two services that gave a correct answer over the phone.

Below we break down each service and provide context on this customer support test.

With Experian, LeaseRunner, and e-renter, we were told a bankruptcy is reportable for seven years, which is partially incorrect.

A bankruptcy is reportable for 10 years per rules of the FCRA.

There are two types of bankruptcies…

Chapter 7 – These remain on a credit report for 10 years from the filing date because there was no repayment.

Chapter 13 – These are deleted seven years from the filing date because there was partial or full repayment.

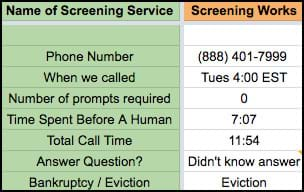

ScreeningWorks answered after a seven-minute hold and didn’t know the answer, and the person who did was in a meeting. I was told they would call back with an answer; I’m still waiting on that.

MyRental was asked about eviction history (they don’t provide bankruptcy information), and I was told, “They’re reportable as far back as the court records will go.”

This is not true and not good advice.

An eviction should never be reported beyond 7 years because you can be sued by a denied applicant for violating the FCRA.

I recommend that you call around and see how responsive your potential tenant screening service is before you select a service.

Their phone support will be a good indicator of their overall customer support and how they handle things.

Up next, we will dive deeper into each service and provide the pros and cons associated with them.

Top 11 Tenant Background Search Reviews

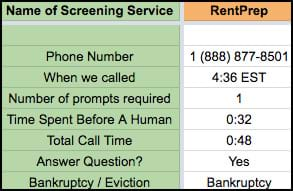

1. RentPrep

Phone Support: (888) 877-8501

Email support: screening@rentprep.com

LiveChat link: Click Here

Online Reviews:

RentPrep Google Reviews (100+)

RentPrep Facebook Reviews (60+)

Disclaimer – This is our own service but we try to stay as objective as possible with our review.

Customer Support:

We surprised one of our screeners and called to ask how long a bankruptcy is reportable for. She was able to answer correctly (10 years) and the call took a total of 48 seconds.

Available Phone Support Hours:

Monday – Friday: 9 a.m. – 5 p.m. EST

Available Live Chat & Email Hours:

Monday – Friday: 9 a.m. – 5 p.m. EST

Saturday & Sunday: 10 a.m. – 3 p.m. EST

Pros:

- RentPrep came in on the lower end of cost

- One of only two services to offer FCRA certified screeners and all three customer support mediums

- Customer service and report accuracy are the strengths of this service that comes with hiring FCRA certified screeners to run reports instead of instant reports

Cons:

- Cannot provide reports instantly

- A credit check does not include the specific credit score of the applicant; it is a pass/fail measure

Note: RentPrep offers the SmartMove screening service.

TransUnion allows our clients the option to see a full credit report (including the score) and also the ability to charge application fees directly to the tenant.

The TransUnion product requires you to enter your tenant applicant’s email.

** Sex Offender, US Criminal, and Homeland Security searches can be added to your order for $6.00.

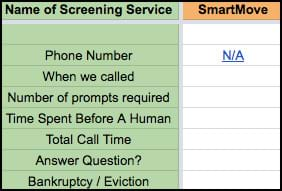

2. TransUnion

No Phone Support

LiveChat: Might popup depending on the page

Online Reviews:

No Google or Facebook reviews found

Customer Support:

SmartMove is offered directly through TransUnion and does not provide phone support. Thus, the reason the image above is blank.

I did use their contact form and asked about eviction data and received a correct response 4 hours and 7 minutes later.

Available Support Hours:

Monday to Friday, 7 a.m. – 6 p.m. MST

Saturday, 8:30 a.m. – 5 p.m. MST

Sunday, 9:30 a.m. – 5 p.m. MST

Pros Of Service:

- A direct product of TransUnion (one of the three main credit bureaus)

- Full credit report

- Have the tenant pay directly for their report instead of using application fees

Cons Of Service:

- On the more expensive side at $35 with a full credit report

- Can’t provide criminal data for all 50 states

- Can’t report data that requires manual extraction

*As noted above, SmartMove is now an option available with FRCA Screener Support through RentPrep.

3. Experian Connect

Experian Connect Phone Support: 1 (800) 831-5614, option 3

LiveChat: None found

Online Reviews:

No Google or Facebook reviews found

The information above is a compilation of four phone calls to get the wrong answer on reporting bankruptcies.

Here are my notes of calling three different numbers and getting hung up on once when I pushed zero out of frustration to get a person on the line.

Eventually, I got to the right number and the TBH (Time Before Human) metric was three minutes and 42 seconds on the final call. The answer I received when I asked how long bankruptcies are reportable for was, “Seven to ten years.”

The correct answer is that bankruptcies are reportable for 10 years.

The reason they give a range is that Experian only reports Chapter 13 bankruptcies for seven years even though they are legally reportable for 10 years.

Available Support Hours:

Monday – Friday 6 a.m. – 6 p.m. PT

Saturday – Sunday 8 a.m. to 5 p.m. PT

Pros Of Service:

- Charges tenant directly instead of using application fees

- Includes judgements/liens

- A direct product of Experian (one of the three main credit bureaus)

Cons Of Service:

- Does not provide eviction data

- Can’t provide criminal data for all 50 states

- Can’t report data that requires manual extraction

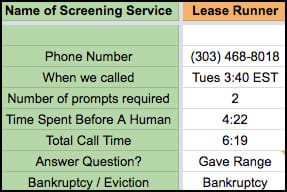

4. LeaseRunner

LeaseRunner Phone Support: (303) 468-8018

Email support: help@leaserunner.com

LiveChat: None

Online Reviews:

No Google reviews found

Facebook reviews (2)

I asked LeaseRunner how long a bankruptcy is reportable for after being on hold for four minutes and 22 seconds. I was told seven years and the person clarified, “That is how far back our reporting goes; however, a bankruptcy is reportable for up to 10 years.”

It’s good that they were able to give a correct answer of 10 years but bad that they only report for up to seven years.

Available Support Hours:

Monday – Friday 8 a.m. – 5 p.m. PT MDT

Pros Of Service:

- You can decide if you want tenant involvement or not

- A la carte pricing

- Good FAQ section

Cons Of Service:

- One of the most expensive services: Credit+Eviction+Criminal = $47

- Our best guess is that a $10 “Financial Report” is a marketing gimmick, which is info usually included for free with credit reports

- $12 for an instant data pull on evictions

5. Cozy

No Phone Support

Live Chat: None

Online Reviews:

No Google or Facebook reviews found

I did reach out to Cozy via their contact form to ask how long an eviction is reportable for (they don’t offer bankruptcies). It took two hours and 14 minutes to get a response. (I emailed at 12:33 p.m. and received a response at 2:47 p.m.)

The email was helpful in talking about how they run evictions, but said, “I’m not aware of a statute of limitations regarding evictions.”

Evictions are reportable for seven years, but the representative that answered the email is a Cozy employee and not an FCRA Certified Screener.

Pros:

- Great design and full credit report

- Offers sex offender, criminal, and Homeland search

- Syncs with other property manager tools

Cons:

- $40 for instant service with a credit report

- Least amount of customer support options for any service

- Doesn’t use all criminal/eviction data

6. Screening Works

Screening Works Phone Support: (888) 401-7999

Live Chat: None

Online Reviews:

No Google or Facebook reviews found

I waited on hold for 7 minutes and 7 seconds before speaking with a person. Screening Works does not offer bankruptcy information on their reports, so I asked how long evictions are reportable for. (The correct answer should be seven years.)

I was told they don’t run evictions for every state but was put on hold to get an answer. The representative couldn’t give an answer on how long evictions are reportable for and said the person who could was in a meeting and would call back with an answer. I never received a call back.

Available Support Hours

I could not find hours of operation.

Pros Of Service:

- Has a Public Records Team that will manually cross-check criminal records (not FCRA certified)

- Pricing is dependent on your State

- Credit check is included (if you want this data)

Cons Of Service:

- Direct quote from their site, “Unfortunately, there are some states within the U.S. that do not have readily available, instantaneous access to Criminal and/or Eviction data, thus they may not be offered by ScreeningWorks for those states.”

- Judgements and bankruptcies not included

- Doesn’t run a national eviction search, just one state

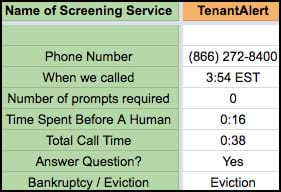

7. TenantAlert

TenantAlert Phone Support: (866) 272-8400

LiveChat: None

Online Reviews:

No Google or Facebook reviews found

Tenant Alert does not provide bankruptcy information, so I asked how long they can report evictions for. I was given the correct answer of seven years. I was able to get a person on the phone in 16 seconds, which was the quickest response of any service tested.

Pros Of Service:

- Offers underwriting option for small landlords

Cons Of Service:

- Doesn’t include eviction data with basic package

- Have to pay $49 to get national eviction data

- It costs less than $1 in extra data costs to get access to national criminal/eviction data over state data

- Majority of landlords will not qualify for underwriting (a dedicated office with an external door, security system, and signage)

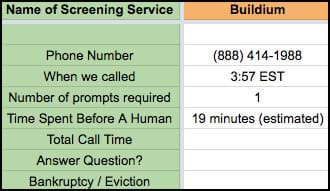

8. Buildium

Building Phone Support: (888) 414-1988

LiveChat: Yes

I called Buildium’s customer support and was given an estimated wait time of 19 minutes. I didn’t bother to wait that long to see if they could answer a simple question correctly.

Pros:

- Offers a full suite of property management tools

- Great design + good customer support

- $15 credit reports with subscription service

Cons:

- *Requires a minimum $45 monthly subscription (0-20 units pricing)

- Instant data report issues (same as previous mentions)

A service like Buildium could make sense if you manage hundreds of units. However, it’s hard to spend a minimum of $540 a year for this service if you only have 0-20 units.

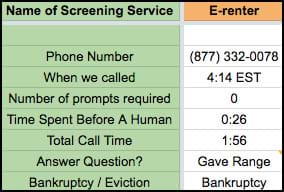

9. E-renter

E-Renter Phone Support (877) 332-0078

Email Support: support@e-renter.com

LiveChat: None

Online Reviews:

No Google Reviews

(Take their reviews with a grain of salt; it looks like people get them confused with the insurance company.)

I called e-renter and asked how long a bankruptcy is reportable for. I was able to get through to a person in 26 seconds. I was told that bankruptcies are reportable for seven years unless you’re running a credit check. In those cases, it is 10 years.

I was given an answer of how far back they will report bankruptcy. I’m not sure why they differentiate how far back their data go based on if you add a credit report or not. Just know if you don’t order a credit report, you’ll only get info seven years back on bankruptcies.

Pros Of Service:

- FCRA certified screeners

- Full eviction/criminal data

- Good support + content

Cons Of Service:

- Requires an additional $2 tenant charge with credit check report (this involves the tenant paying a $2 charge)

- Doesn’t include a full credit score report

- Poorest designed site on the list

10. Tenantify

We decided to not test customer support for this service because they do not offer bankruptcy or eviction data.

Online Reviews

No Google or Facebook reviews found

Pros Of Service:

- A la carte employment and income verification

Cons Of Service:

- Doesn’t offer eviction data

- Doesn’t offer credit reports

- Doesn’t offer enough services to be useful as a standalone tenant screening service

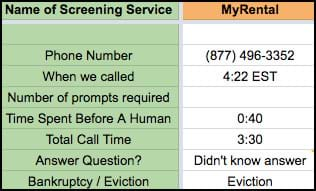

11. MyRental

MyRental Phone Support: (877) 496-3352

LiveChat: Yes

Online Reviews:

No Google or Facebook reviews found

I called MyRental and asked how long an eviction is reportable for since they don’t offer Bankruptcy data on their basic report. I found this phone support test to be the most troublesome.

I was told that eviction data goes back as far as court records will go. I prodded more and asked if there are any kind of laws that limit the reporting of evictions. I was put on hold and eventually were told they are reportable for seven years.

This was concerning because the first answer is the type of reply that can get a landlord in trouble. If a landlord uses an eviction from eight years ago as reasoning to deny a tenant applicant they could be liable for a lawsuit.

Pros Of Service:

- Offers sex offender, criminal, and Homeland in basic

- Owned by CoreLogic

- Doesn’t require tenant involvement

Cons Of Service:

- Doesn’t include bankruptcies + judgments/liens

- Instant reports = not the best possible data

- Large corporate company = not ideal customer support

How To Use This Data To Select A Tenant Screening Service

Once you understand what to look for, it really depends on your preferences.

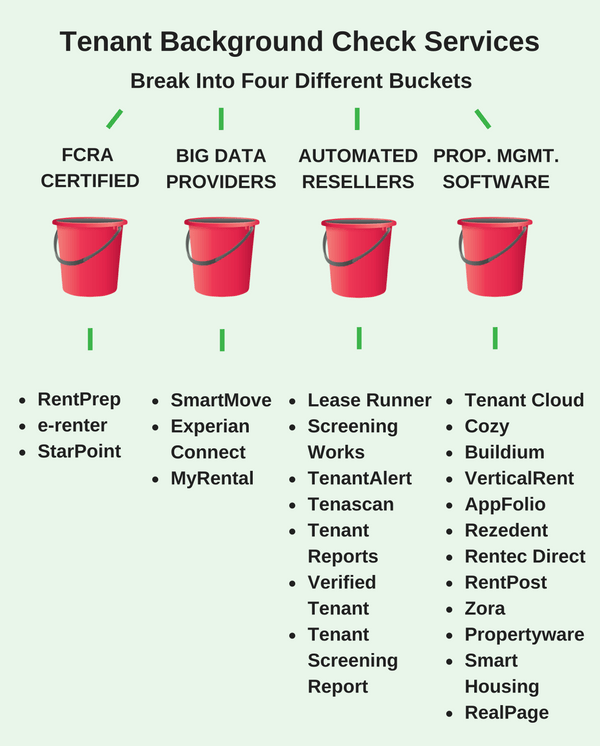

If we were to group the services together by their most defining feature, here’s how those groupings would look.

You’ll notice we added additional services for this infographic.

The two buckets on the right have an endless supply of automated resellers and property management services.

FCRA Certified Screeners:

Pros – Most Accurate Reports & Good Customer Service

Cons – Can’t Provide Instant Results & Can’t Provide Full Credit Check

Big Data Providers:

Pros – Pulling From Own Data Sources

Cons – Automated Reports Create Issues For Eviction/Criminal Data

Automated Resellers

Pros – Some Are Cheaper Than Big Data Providers

Cons – Add Little Value Compared To Big Data Providers

Property Management Software

Pros – Manage Properties In One Place

Cons – Some Charge Monthly & Most Are Automated Resellers

Not A Full Screening Solution

- Tenantify

Other Tenant Background Check Services For Landlords Worth Mentioning:

1. Tenant Magic Reviews

Tenant Magic is a newer service in the past few years. They were left off of this review due to being focused on realtors as opposed to landlords for their product. They also do not make their pricing publicly available for their service. Based on the data available, they’re white-labeling SmartMove for their tenant screening.

What Is The Best Background Check For Landlords?

We can’t speak for other screening companies as we can for RentPrep, but here’s what we’ve learned in the past 10 years of running our business.

We provide the most comprehensive screening reports available but they take an hour to compile and won’t show you a credit score.

This model works for landlords who want accurate criminal and eviction data. It does not work for landlords who insist on having access to the full credit report instead of a credit check.

Here’s an explanation of what is included in our credit check services for landlords.

What Is The Best Credit Check For Landlords?

If you want a full credit report quickly, we recommend using our SmartMove product.

SmartMove is the best credit check for landlords who are looking for an instant solution including a full credit score.

If you want to keep everything in one program but still want high-level screening reports, we’d suggest a service like TenantCloud.

FAQs About Tenant Background Check Reviews

What Is The Best Tenant Background Check?

Every service has it’s pros and cons, but the balance of price, speed, and accuracy is most important when it comes to tenant background checks. One of the best options you can find today is the SmartMove service offered via RentPrep.

By using this product from us, you can get a full tenant credit report quickly in addition to any other background information you are interested in. Additional screening solutions offered by RentPrep give you a comprehensive background check in just one hour.

Is A Tenant Background Search Legit?

Yes; tenant background searches done through a legitimate provider can give you true information about potential tenants. When using the services offered here on RentPrep, for example, you can get a complete and comprehensive list of verified information about tenants to ensure they will be a reliable fit for your property.

What Kind Of Background Check Do Landlords Do?

Landlords do different types of background checks depending on what their criteria for renters are. Background checks can include criminal background information, eviction history, employment history, consumer reports, credit reports, and more depending on the state the check is done in.

Who Pays For Background Check: Tenant Or Landlord?

It is up to you, the landlord, to determine who is going to pay for the background check. If you are in a high-demand area, having prospective tenants pay for their own background check is possible and favored by many landlords. If you can cover the costs or want to be more competitive with other local landlords, paying for the checks as a landlord may be a good idea.

How Do I Do A Free Background Check On Tenants?

At this time, none of the reliable background check services for landlords that we have investigated can do a comprehensive background check for free.

As a landlord, you can request that tenants pay directly to file their applications and associated background checks. This would make the check free for you, but you cannot profit off this transaction. The application can usually be sent directly to their email address so the payment portion is handled without your involvement.

What Is The Best Credit Check For Landlords?

Landlords will get the most out of using the comprehensive tools that we have available here at RentPrep. In addition to being a great source of information for landlords, our credit report gives a simple pass/fail measure that can make it easier than ever for landlords to make decisions about tenants. The service is completely optimized in favor of the needs of a landlord.

If you are more interested in tenant credit checks that give an exact number, using the TransUnion service via RentPrep is a great option.

How Do You Know If A Landlord Is Legit?

The best way to know if a landlord is legit is to talk to them directly and find out if they have any information or references about their business that they can provide. Many landlords, however, only manage one or two properties and may not have this type of information.

If something seems very off about your landlord, research these two things:

- Search the property address records and make sure that the landlord is the legitimate owner; if they’re not, contact the owner and make sure the landlord is acting with their permission.

- Search court records to make sure the property is not up for foreclosure.

Landlords who are scammers are most likely to be guilty in one or both of these situations, so checking those records is a good way to reassure yourself before renting. Additionally, landlords who want to deal in cash only, refuse to meet with you in person, or ask you to wire them money before anything may be up to no good.

How Do You Know If A Rental Property Is Legit?

The best way to know if a rental property is legit or not is to pay attention to how the landlord acts. As explained in the question above, sketchy individuals posing as landlords will sometimes try to take advantage of renters. By monitoring the landlord, you should be able to determine whether or not you are dealing with a legitimate property.

What Causes A Red Flag On A Background Check?

When it comes to tenant screening, the most common red flags that cause landlords to reject an application are:

- Unreported criminal history on criminal background check

- Unreported bad credit

- History of eviction or rental issues

- Blank spaces on the application

- Non-matching social security number

- Negative consumer reports for credit cards

What Can Disqualify You From Renting An Apartment?

There are many legal reasons that a landlord may choose to deny a rental application; these are some of the most common reasons for rejection:

- Unverified or lacking source of income verification

- Bad credit or number outside of wanted credit score range

- Unverifiable references or rental history

- Refusing to give previous address

- Unreported criminal history

- History of evictions

- Payment history problems

- Unexplained gaps in employment or rental history

- High number of credit accounts

For a landlord, many of these things can be red flags. If you know your application will show any of these problems but can explain it, it’s best to do that upfront so your landlord can make a fair judgment.

Did We Miss Something?

Nowadays, there are more screening solutions than ever before for landlords who want to run credit and background check services on prospective tenants. This is because most services are just instant resellers of data coming from TransUnion, Experian, and Equifax.

We did our best to fairly compare the services listed in this report. If you visit each service, you will see different levels of packages, but it would be too difficult to show everything each service offers. Our goal was to make it so you can get an easy understanding of the differences in services available. With that info, you can choose the right fit.

If you do want to learn more about RentPrep’s beginnings and why we put so much effort into educating landlords, I recommend checking out our About Us page where our CEO tells his story of how he started the business.