We recently reviewed 11 of the best tenant screening services on the web. Leaserunner reviews were included in that breakdown and in this post we will expand further on the service.

Full disclosure, here at RentPrep we are a tenant screening service but our purpose of this lease runner review is to give you an outside perspective from someone with industry knowledge.

Leaserunner Reviews – The Ugly

First, it’s important to understand what metrics play a key role in judging a tenant screening service.

The following metrics are good benchmarks to compare this service:

- Accuracy of data

- Eviction data

- Cost

- User involvement

- Good value adds

- Bad value adds

Leaserunner Reviews – The Good

+ Tenant Involvement Flexibility

The thing I like most about this service is the flexibility of tenant involvement with the screening process.

This means you get to choose if you want to do the entire process with or without the tenant.

If you don’t include the tenant you can typically get through the process much quicker and easier because it’s one less cook in the kitchen.

The advantage of including the tenant is that you can have leaserunner bill them directly but then you’re adding additional steps to the process.

This is really up to you and what your preference is.

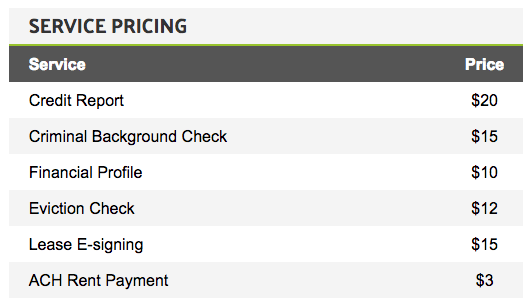

+ A La Carte Pricing

The way Leaserunner prices their service you can choose services individually. This is good for a landlord who may only need just one aspect of data.

I wouldn’t suggest renting to someone just based on a criminal background check but perhaps you have a unique reason for why that’s all you need.

+ Full Credit Report

Not every screening service has the ability to offer a full credit report. This will give you a specific score and more details on the credit report.

+ Suite of Services

Leaserunner acts as a property management tool in that you can list, screen, lease, and collect rent all on one platform.

They don’t charge a monthly fee for any of these services and break them out as needed.

Some of these services are nice but there are some issues with this but I will address those later on in this post.

Leaserunner Reviews – The Bad

– A La Carte Can Add Up

When you screen tenant applicants you want to look at reliable data to make your decision.

The way Leaserunner lays out their services I would suggest getting at least the following:

- Criminal Background

- Eviction History

- Credit Report

These three items will run you $47 for one tenant applicant.

Out of the 11 tenant background services we reviewed this was by far the most expensive.

The average cost for these services ranged from $28 – $40 for the other 10 services.

The option for a $15 e-lease seems pretty expensive.

Typically document signing services such as hellosign or docusign will charge around 50 cents to a dollar per form depending on volume for enterprise solutions.

Leaserunner has the right to charge $15 for this service but you can also search for a better option.

– Instant Results Come From Instant Data

This screenshot is pulled right from the main tenant screening page on the Lease Runner site.

You see many tenant screening websites touting to be an instant solution. This just means that the service is pulling instant data, adding a markup, and invoicing the end user for that data.

It’s bad because if there is inaccurate data on the report there is no one checking it before you see it. There’s no added line of defense between the landlord and a discrimination lawsuit.

In some states (Wyoming, Delaware, Massachusetts, South Dakota, and most recently Colorado) you cannot pull instant criminal data. It has to be manually extracted and any instant service cannot do this.

This means if you live in those states you won’t get criminal history and if you applicant lived or committed crimes in those states you won’t get that data either.

Leaserunner Reviews – The Ugly

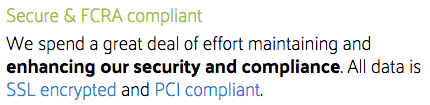

– FCRA compliant?

This screenshot is pulled from the site as of 12/20/16.

The title of “Secure & FCRA compliant” is extremely misleading.

The security of the website has very little to do with FCRA Compliance.

You’ll see mention of “PCI compliant” and the website very well may be PCI compliant. This has to do with data security standards for organizations that handled credit cards.

FCRA compliance has to do with the data that is being reported by CRA (Credit Reporting Agencies).

For instance… you can’t deny a tenant applicant the apartment because they have a bankruptcy from 11 years ago. If you’re working with an FCRA Tenant Screening service they will have FCRA certified screeners hand-compile your report to ensure accuracy.

This is an instant service which means no one is looking over your report for false positives, missed information, and erroneous information.

– Issues With Rental Application & Tenant Involvement

On the surface, the option to post your rental online and have applicants apply and immediately pay for their background report sounds great.

You the landlord would know a lot of information before ever even speaking with the applicant.

This is very bad for several reasons.

When you deny a tenant applicant based on the tenant screening report you have to send them an adverse action letter informing them they didn’t get the rental.

The proper way to screen tenants is to create screening criteria and prescreen applicants before you show the rental. If you don’t accept pets or smokers and they have a dog you can legally not rent to this person and you don’t need to run a tenant screening report because you prescreened them first.

Let’s say hypothetically you post your rental using Leaserunner and you get 26 applicants all who decided to submit to the background check.

That’s 25 applicants you need to submit an adverse action letter to. It’s great for the tenant screening company because they just got 25 orders but it’s a bad experience for a compliant landlord and even worse for the renters who are denied and never had a chance.

– First-Come First-Served Renter Laws

Seattle is the first city to sign this into effect. What it means is that you create screening criteria for your rental. You must offer the rental to the first applicant that passes your criteria. This law is signed into effect to limit discrimination by landlords.

If we go back to the last example there was 26 applicants. Since you’re not prescreening you would need to offer the rental to the first person who passes your criteria.

It wouldn’t be surprising to see this law signed into effect in other areas and is already being heavily pushed in California.

With Leaserunner the background screening step is being introduced way too early in the process.

I believe the reason for this is because it presents an opportunity to make even more money for the screening company while ignoring issues that will be created for the landlord.

In conclusion…

Leaserunner absolutely makes sense if you want quick data just on criminal or just a full credit report.

However, once you start stacking a full screening report together you will see that it is one of the most expensive options on the market.

If you’re only interested in their property management tools I would suggest a service such as TenantCloud or Cozy because they don’t charge for simple services ($15 for a digitally signed lease agreement is a little steep).

For most consumers… Leaserunner will be an expensive option that has some compliance flaws that come with being an instant solution.