Updated January 2023

The financial aspect of working in the rental industry often becomes overwhelming. For both new landlords and those with experience, tax time is a challenging part of the year. One topic that’s been confusing landlords in recent years is bonus depreciation.

Bonus depreciation is a type of tax deduction that has been updated for a short period of time to cover the entire cost of specific expenses, purchases, and investments. As a small business, 100% bonus depreciation applies in some scenarios.

The trick, however, is knowing the bonus depreciation rules on rental property, to understand where these tax benefits make sense for your business. Figuring out these guidelines, however, is not always easy.

RentPrep’s complete guide on bonus depreciation leads you through what bonus depreciation is and how you may want to apply it to your business.

Table Of Contents On Rental Property Bonus Depreciation

Taking advantage of tax cuts is essential for the long-term success of your business. It’s time to find out if and how you can apply bonus depreciation on real estate expenses to your financials, to ensure the best deductions and biggest profits.

- What Is Bonus Depreciation?

- Rental Property & Bonus Depreciation

- Using Bonus Depreciation On Rental Property

- FAQs: What Is Bonus Depreciation?

- How does bonus depreciation work?

- Why would you not take bonus depreciation?

- Can I take bonus depreciation on real estate property?

- Which is better: Section 179 or bonus depreciation?

- Can a business take section 179 and bonus depreciation simultaneously?

- What are the Top Tax Deductions for Rental Property Investors?

- The Value Of Rental Property Bonus Depreciation

What Is Bonus Depreciation?

To understand bonus depreciation, we must first understand normal depreciation, how it functions, and why it’s useful for businesses.

Depreciation

Depreciation is a process through which assets bought by a business are deducted and written off as business expenses. Deductions for items with immediate and short-term usage, such as a notebook, are done at one time.

Depreciation can often be the largest recurring tax deduction for rental property owners. This is important because it’s a non-cash expense, reducing taxable income without reducing actual cash flow.

Other items will be used over a period of years, and those items need to be depreciated rather than outright deducted. The deduction is taken a little at a time over a number of years. This is known as depreciation. The IRS assigns lifespans for specific assets, and those lifespans must be used to calculate depreciation.

Bonus Depreciation

Bonus depreciation is a specific type of depreciation. With this method, a higher percentage of the total cost of eligible assets can be deducted in the first year rather than spread out evenly over a period of time. This accelerated depreciation allows businesses to take larger deductions when making purchases without waiting for depreciation periods to apply.

Eligible assets are typically any properties with a Modified Accelerated Cost Recovery System as defined by the IRS to have a recovery period of fewer than 20 years. Real estate investment properties, for example, would not be eligible because they have a depreciation period of 27.5 years for residential properties.

The Tax Cuts And Jobs Act Of 2017 (TCJA)

The IRS code permits bonus depreciation of up to 100% of eligible business assets, thanks to the TCJA Act. Previously, only 50% could be deducted this way, but the act changed the tax code to encourage investment in business growth and assets.

Qualified business assets purchased in applicable years may immediately depreciate for 100% of the cost in business deductions. This applies only to property put into service between September 27, 2017, and January 1, 2023.

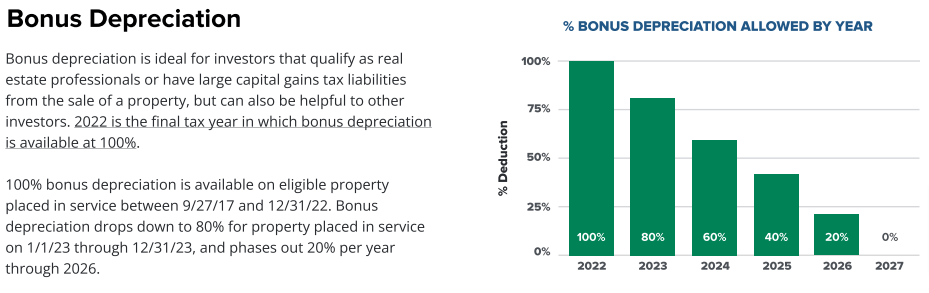

This act will not continue to have 100% bonus depreciation indefinitely. The deduction will be phased down over a period of several years as follows:

- 2022: 100%

- 2023: 80% for property entering service between 12/31/2022 and 1/1/2024

- 2024: 60% for property entering service between 12/31/2023 and 1/1/2025

- 2025: 40% for property entering service between 12/31/2024 and 1/1/2026

- 2026: 20% for property entering service between 12/31/2024 and 1/1/2027

In addition to establishing updated bonus depreciation rules, the IRS code was also updated to include additional types of allowable deductions within nonresidential real estate properties:

- Qualified improvements to a building’s interior, excluding enlargement, elevators, escalators, and structural framework

- Roofs

- HVAC systems

- Fire protection systems

- Security systems

Rental Property & Bonus Depreciation

Understanding how bonus depreciation applies to rental properties is a confusing topic. Let’s set up the framework by reviewing how real estate depreciation works.

Depreciation applies to real estate to cover the cost of a property over time as its value goes down. Every tangible aspect of real estate other than the land’s value can be depreciated. The specifics of how this works are outlined in IRS Publication 946.

Bonus depreciation is an ideal tool to leverage when you are an investor that qualifies as a real estate professional or has large capital gains tax liabilities from the sale of a property.

To be eligible for depreciation, the following conditions must apply to the real estate property:

- Owned, not rented, by the taxpayer

- Used for business or investment purposes

- Have a specific useful life period

- Have more than one year of expected use

Real estate properties can be depreciated in a few different ways.

Straight-Line Depreciation

This is the most common type of depreciation used for rental properties. The cost of residential real estate purchased as an investment is depreciated over the span of 27.5 years. For commercial real estate, the period is longer. Some items within the property, such as carpeting or appliances, can be deprecated over shorter timelines.

Declining Balance Depreciation

In this depreciation method, the investor takes a larger depreciation deduction at the start of the asset’s useful life. Over time, the depreciation declines as the balance value remaining on the asset also declines. The complete terms of how declining balances work in the tax code can be found here.

Bonus Depreciation Rules

Finally, let’s talk about bonus depreciation. This 100% bonus depreciation enables taxpayers to deduct the entire cost of an eligible asset the first year it’s put into use.

However, this bonus depreciation does not necessarily apply when it comes to investment and rental properties. The useful life for assets under this depreciation method must be less than 20 years. Investment properties have a minimum depreciation period of 27.5 years.

How, then, can landlords and investment property owners benefit from bonus depreciation if it cannot be applied to property purchases? Keep reading to find out how to benefit from this tax cut.

Using Bonus Depreciation On Rental Property

There are several categories where you can claim extra deductions through bonus depreciation. These are the areas most likely to apply to rental property owners and landlords.

Land Improvements

Excavating, grading, landscaping, fencing, and more have a depreciation period of 15 years. This means they are eligible for deductions through bonus depreciation. Check the specific type of land improvement’s depreciation period, as it may vary.

Personal Property Assets

Personal property typically has a depreciation period of fewer than 10 years when used inside rental property. New items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before.

Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction.

Skip The Repairs

While determining what can and cannot be included in bonus depreciation, it’s important to remember the distinct differences between repairs and improvements. Repairs are done to keep the property in habitable condition. They can be deducted as a regular business expense in the year the repairs are made.

On the other hand, improvements change a property for the better in the long term. These changes must be depreciated over time when they are expensed.

The Changing World Of Rental Properties

If there’s one constant about the rental industry, it’s that things are always changing.

Even if those changes are minute and take time to become noticeable, they will ultimately affect your business. Landlords like you already have their days full of management activities—keeping up with the industry often feels impossible.

Sign up for RentPrep’s newsletter today. We provide updated resources, landlord forms, and other valuable references to simplify what it means to be a landlord. Spend less time researching the industry and more time implementing improvements with the knowledge we share.

FAQs: What Is Bonus Depreciation?

How does bonus depreciation work?

Bonus depreciation is a particular type of depreciation. In standard tax accounting, business assets such as rental properties are deducted over a predetermined period representing the asset’s usable lifetime. For real property, for example, the value is deduced equally over 27.5 years.

Bonus depreciation changes the way that depreciation works. Assets acquired during the bonus period (September 27, 2017, to January 1, 2023) can receive 100% depreciation deductions in the first year. This deduction is taken the first year that the asset enters service with the company. These rules only apply to specific assets and types of property.

Companies that prefer to stick to straight-line depreciation are permitted to do so, but many find the benefits of bonus depreciation to be valuable.

Why would you not take bonus depreciation?

Some companies choose not to take the bonus depreciation because they have a low net income right now. It would be more beneficial to their business to spread the deductions over time through standard deducting methods rather than taking a large deduction at once. This will help balance their income-to-deduction for better tax filings long term.

For businesses with a larger net income and an interest in lowering their taxes, applying the bonus depreciation while it’s in effect is the most common action taken.

Can I take bonus depreciation on real estate property?

Suppose you’re purchasing new real estate property for your rental business in tax years when bonus depreciation will apply. In that case, it’s important to understand that bonus depreciation can only be applied in specific ways.

The most straightforward way to apply the bonus is to any improvements made to the property. These are covered under both bonus depreciation and Section 179.

However, the total value of the property will still be divided out over 27.5 years as it is for straight-line depreciation for residential investment properties.

Some investors have cost segregation studies done on their properties to optimize how much they can deduct through bonus depreciation. A cost segregation study divides the value of a purchased property between the relevant components. For example, rather than valuing the entire property at $100,000, the study will divide the value between property component, such as:

- House: $85,000

- Appliances: $5,000

- Flooring: $10,000

Since appliances and flooring have shorter depreciation periods than the house itself, the amount that can be deducted through bonus depreciation is higher when using this method. If you plan to use this segregation method to cut taxes for your business, ensure you work with a qualified tax accountant to file everything correctly.

Which is better: Section 179 or bonus depreciation?

Neither § 179 nor bonus depreciation is better than the other. Rather than considering these tax cuts relationally, it’s better to understand that they have different functions and results.

- 179 is typically applied first. It has a limit of $1 million. No matter how much you deduct, you cannot create a net loss for your business using § 179. You can only deduct amounts less than or equal to your business income.

On the other hand, there is no annual dollar limit on bonus depreciation or business income limitation. This is meant to be a tax cut for businesses and can help many get more back from the depreciation of their business assets.

Can a business take Section 179 and bonus depreciation simultaneously?

Businesses have many options when deciding how to file their taxes. If your rental work is done through a business setup, you’ll need to determine if you want to use Section 179 exclusively, bonus depreciation, or both simultaneously. It is possible to use them both.

When using them both, IRS rules state that businesses must apply Section 179 to their assets first. If the amount being deducted goes beyond Section 179 limits, bonus depreciation can also be used. Otherwise, businesses should choose which they want to use and stick to that single type of deduction.

As always, working with a tax accountant is best in order to find the right setup for your business. The rules apply differently depending on where you are located and how your business is structured, so it’s important to get an expert’s eyes on your documents before filing taxes.

What are the Top Tax Deductions for Rental Property Investors?

Understanding how to exercise depreciation as a tax deduction is a key step for rental property investors. There are a variety of other tax deductions rental property investors can take advantage of such as:

- Repairs & Maintenance

- Professional Fees

- Taxes & Insurance

- Employees & Independent Contractors

Check out RentPrep’s sister company, Stessa for a complete guide on the Top Tax Deductions for Rental Property Investors .

The Value Of Rental Property Bonus Depreciation

Some investors and landlords have written off the true value of rental property bonus depreciation because these tax cuts do not apply to every aspect of their business. However, tax cuts are cuts even if they are limited in scope.

The 100% bonus depreciation doesn’t apply to every investment, improvement, or expense you have in the rental industry. It does, however, offset the cost of capital improvements, large equipment purchases, and other real expenses that are likely affecting you.

There are a few ways to ensure you’re getting the most out of bonus depreciation while it applies:

- Keep track of all of your expenses. Be detailed, so it’s clear and easy to recall what was purchased, for what purpose, and when that purchase was put to use.

- Work with a qualified tax accountant to choose what type of depreciation to apply and when—different types of depreciation will work best in different situations.

- Stay updated with changes in tax cuts. The IRS releases updates to guidelines as they occur, so visit their website for the latest news.

There’s no doubt that landlords and rental investors can benefit from bonus depreciation, even if the rules are somewhat confusing. Take time to understand the particulars to ensure you aren’t missing out on this benefit.