Landlords know that when renting their property, they should run a tenant background check on qualified applicants. Sometimes, applicants want to include a cosigner or someone who is responsible for the rent if the tenant fails to pay.

You might be wondering how to handle a co-applicant for apartments? Do you screen them the same way? Do you run a background check on them?

Sometimes this cosigner is called a guarantor.

What is a guarantor?

A guarantor is a person or organization that guarantees something. In the case of a tenant, the guarantor or cosigner is guaranteeing that the tenant will pay their rent.

If the tenant cannot pay the rent the guarantor/cosigner will be on the hook for rent payments.

Many landlords wonder if they should run a background check on the cosigner.

Why Some Co-Applicants Need a Cosigner

Having a co-signer is like insurance for landlords that are considering applicants that do not meet the minimum income level, credit score or background check.

For applicants that have poor credit or no credit, a co-signer can help them to qualify for rental properties that they would otherwise not get. College students that haven’t had much time to build up credit commonly have co-signers that are their parents or other relatives. Other people that might need co-signers include those with recent bankruptcies, divorce, a brand new job, or a previous eviction.

Sometimes, landlords allow a co-signer to be part of the lease agreement as long as they pass a background check. Other landlords simply don’t allow co-signers. There’s no law that states landlords have to accept applicants with co-signers.

Why Landlords Should Run a Background Check on a Co-Applicant

The best way to find out what kind of tenant an applicant will be is to run a full background check on them. In the same way, landlords should definitely do a background check on a co-signer.

If the co-signer meets all the requirements for employment and financial stability that the applicant lacks, the landlord could go ahead and approve the application.

Many landlords and property managers will require that a co-signer makes at least 3x the rent amount in salary.

The reason being is that a co-signer typically has more debts. If a parent is co-signing on a college student’s housing the parent probably has a mortgage and other larger bills. For this reason, you may want to create a more stringent screening criteria for the co-signer.

In the event that the tenant does not pay rent on time, is evicted or damages the property, the landlord has the legal right to charge the co-signer for the money. By being a co-signer, they agree to be financially responsible in the event that the tenant is not.

RentPrep’s Take On Whether to Run a Background Check on a Co-Signer

The landlords we associate with agree that everyone should run a background check on a co-signer. That’s because they feel that if the applicant is not strong enough to get approval on their own, it may be a sign that they won’t be a good tenant.

However, there are many cases where applicants have poor credit or employment history that are otherwise good choices. Circumstances of being a college student, medical bills, recent divorce, single parents, and unemployment can throw otherwise excellent tenants into a real mess.

A co-signer can be that bridge the person needs to get back on their feet.

Landlords always need to determine what works best for them. They must make sure their rental properties are full of good tenants that pay rent and take care of the place. If they do allow it, they definitely need to run a background check on a co-signer.

What Are Other Landlords Saying About Whether to Run a Background Check on a Co-Signer?

At the 4:59 mark in the video above we discuss co-applicants for college rentals and how to handle the screening of these individuals.

Every landlord needs to do what is best for their rental property and their budget. Co-signers are just as financially responsible as the tenant, giving landlords lots of options in the event something goes wrong.

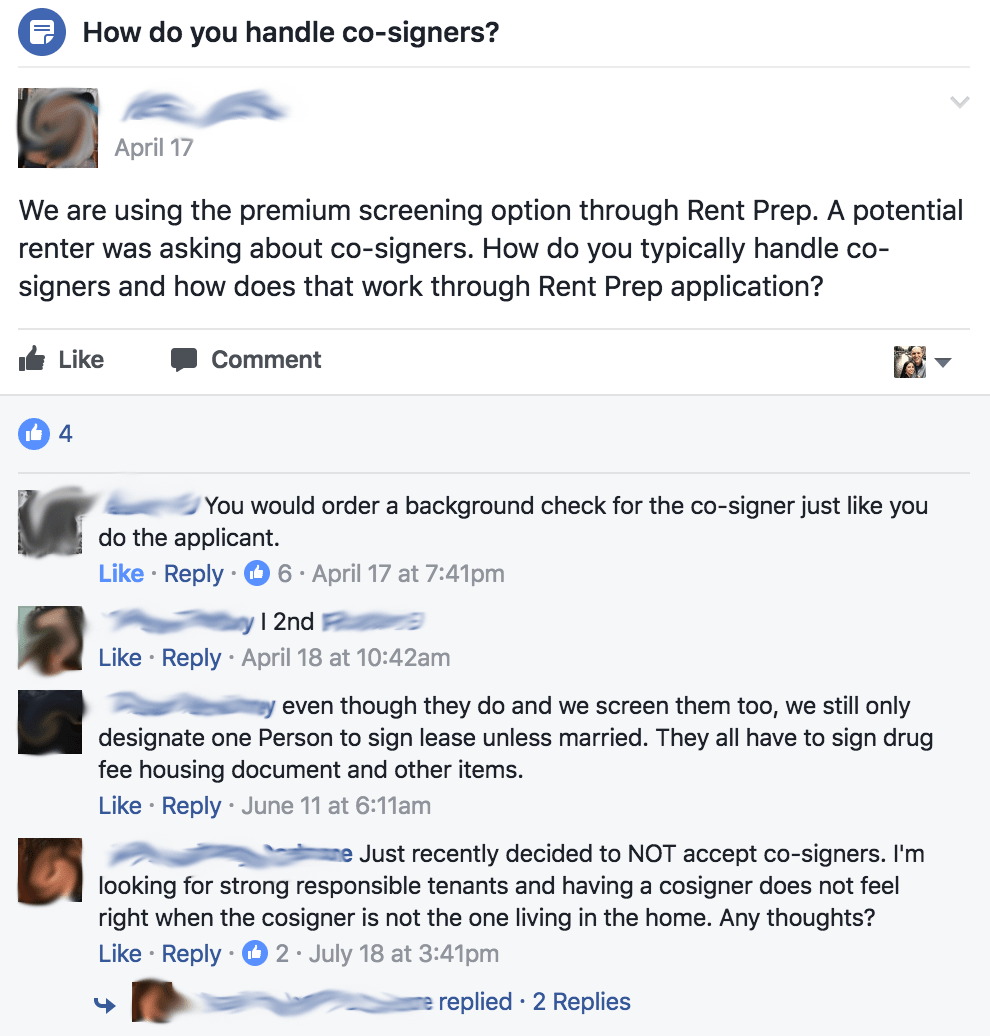

Here’s a screenshot of landlords discussing this question in our private Facebook group for Landlords.

You can see even more comments on that post by checking it out in the group.