This week we discuss a new tax incentive similar to (but better than) a 1031 exchange, where you can save up to 15% on capital gains.

Click here to listen on iTunes.

Click the Big Green Play Button to Listen to the Podcast

[iframe style=”border:none” src=”//html5-player.libsyn.com/embed/episode/id/7218911/height/100/width/480/thumbnail/no/render-playlist/no/theme/custom/tdest_id/576742/custom-color/#87A93A” height=”100″ width=”480″ scrolling=”no” allowfullscreen webkitallowfullscreen mozallowfullscreen oallowfullscreen msallowfullscreen]

Subscribe: Apple Podcasts | Android | Stitcher

Join our Facebook Group of over 8,000 landlords and property managers

Have a Question for Mark J. Kohler about Opportunity Zones?

You can ask your questions in the comments and watch a live interview of Mark on our Facebook Page.

Show Notes:

0:00 – 0:45 Eric Introduces the show.

0:46 – 1:27 RentPrep has worked with attorney, CPA, and best-selling author Mark Kohler on several important topics in the past. Check out Podcast Episode #180 to hear him about protecting your assets by forming an LLC.

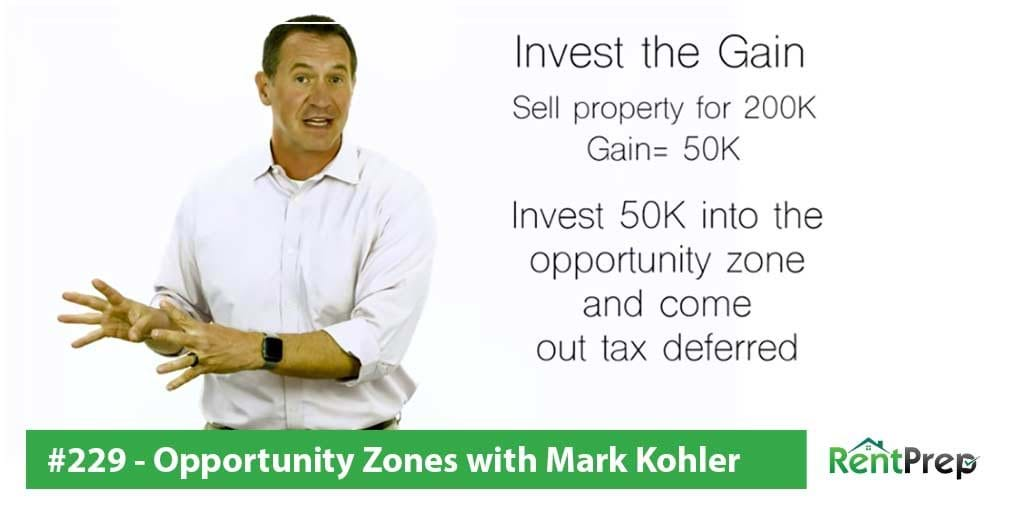

1:28 – 2:30 What is an “opportunity zone?” If you own real estate right now, and make a sale at a profit, the profit margin is referred to as capital gains. You have the chance to invest capital gains into a real estate partnership, where you’ll buy real estate in an opportunity zone, to defer some of the taxable gains from the sale of your original asset.

2:31 – 3:40 A snippet from Mark Kohler called “Opportunity Zone Strategies” You can check it out on YouTube. Mark has 5 strategies that you can use to really benefit from opportunity zones.

3:41 – 4:35 Defer the taxable gain on your property. If you make a 10% profit on your sale, then that 10% is all you’d have to use toward investing in an opportunity zone to defer gain taxes.

4:36 – 5:12 Any capital gain is eligible for investing in opportunity zone. Even stock gains.

5:13 – 7:12 The gain is reduced over time. The longer you hold the property, the lower the taxable gain gets. If you hold the property for 5 years, the gain is reduced by 10% if you hold the property for 7 years the gain is reduced by another 5%. The tax deferment period ends in 2026, when you’d pay the reduces taxable gain.

7:13 – 8:14 There is an exclusion for taxed appreciation value. You pay zero tax on any appreciation on the property’s value during a sale if you hold it for at least 10 years.

8:15 – 10:12 Be sure to get the opportunity zone into an LLC. These properties are typically in dilapidated areas you should protect them and yourself.

10:13 – 10:41 “Knowledge speaks, wisdom listens.” -Jimi Hendrix

10:42 – 11:07 Live interview with Mark Kohler on opportunity zones. October 26th 1pm est. Check it out on the RentPrep for Landlords Facebook page.

11:08 – 12:41 On October 20th you can see a scheduled post for this interview. Leave any questions you may have on the scheduled video post, so we can answer them during the live interview!

12:42 – Eric closes out the show.

Can you do us a solid?

Our podcast has grown over the years because of listeners like yourself. One way you can help us grow further is by leaving us a review of our podcast. It will only take a minute and you can find detailed instructions by clicking here.

Resources Mentioned in this Episode:

Mark’s Video:

https://www.youtube.com/watch?v=tOqm9qDumT8

Our Facebook Page where the live video interview will be held on October 26th as 1pm EST:

https://www.facebook.com/pg/tenantscreening/videos/

Articles mentioned in video:

https://kkoslawyers.com/the-new-and-wonderful-world-of-oz-opportunity-zones-provide-tax-deferral-tax-reduction-and-tax-free-gain/

https://kkoslawyers.com/what-is-a-qualified-opportunity-zone-fund/