As a landlord, you’re running your own business. You manage your own finances, file your taxes, and pay your bills. There are a lot of moving parts that you are in charge of keeping track of, and sometimes, that’s going to get overwhelming.

When there is so much going on, some landlords forget to set aside time to manage their personal finances in addition to the business’s finances. Despite how it might feel, those are two separate categories. All landlords need to remember that!

One thing that many landlords don’t think about setting up right away is their own retirement contribution; do you have one set up? They also don’t consider ways to diversify their loan or investment opportunities; have you done this?

If you don’t have some type of personal 401k retirement savings plan set up, it’s time that you sit down and figure out what you should be saving and how you will do that. Some small business owners choose to set up what is known as a solo 401k account. Essentially, this is a type of 401k savings plan that you can create if you are a business owner with no employees.

There are a lot of landlords who fall into this category; if you are one of them, it may be time to set up your solo 401k. If a solo 401k isn’t for you, there are IRA LLC options as well. Though the process can be confusing, there are services out there such as MySolo401k.com that can help you through it.

Today, we’ll be visiting MySolo401k reviews so that you can find out if this tool will help you create foundations you will be able to rely on in the future.

Table Of Contents

- MySolo401k Rating

- MySolo401k Reviews

- MySolo401k Analysis

- Products Available From MySolo401k

- A Note For Landlords About Plan Types

MySolo401k Rating

MySolo401k earns a 5/5 star rating for the services it offers for landlords and other small business owners working in the real estate sector.

MySolo401k Reviews

MySolo401k.net gets a 5/5 star rating because the team at this company does a great job of explaining its services thoroughly to potential customers before they make the jump to sign up.

Additionally, they follow through with their promises to ensure that every client gets the documentation, support, explanations, and education that they need to successfully use their 401k or IRA services. While the services offered by MySolo401k might not be a good fit for every landlord, their offerings are a very good choice for those that are interested.

Pros

- Lots of support from the team

- Huge vault of educational material

- Reasonable pricing options

- Multiple products depending on what type of trust or account you need to create

Cons

- May still need to consult with a personal CPA if their info isn’t enough

- Complex but well-explained options

MySolo401k Analysis

MySolo401k is a company that offers people and their businesses the ability to set up solo 401k trusts, 401k business financing, and IRA LLC plans. While their primary service is their solo 401k support, their services do extend beyond that.

If you aren’t familiar with what a solo 401k is or how they are typically used, this video from George Blower of MySolo401k.net can help you build the foundation that you need:

Complete Solo401k Set-Up

While it is possible to set up a solo 401k without any assistance from a brand or company, it can be very costly and time-consuming to do so. This is because there are certain permissions that must be set up by the IRS before you can create this type of trust, and the process to get those permissions can take up to two years.

That is why even landlords and business owners that like to do things for themselves wind up looking for a company that has the ability to set them up for retirement success safely and comfortably.

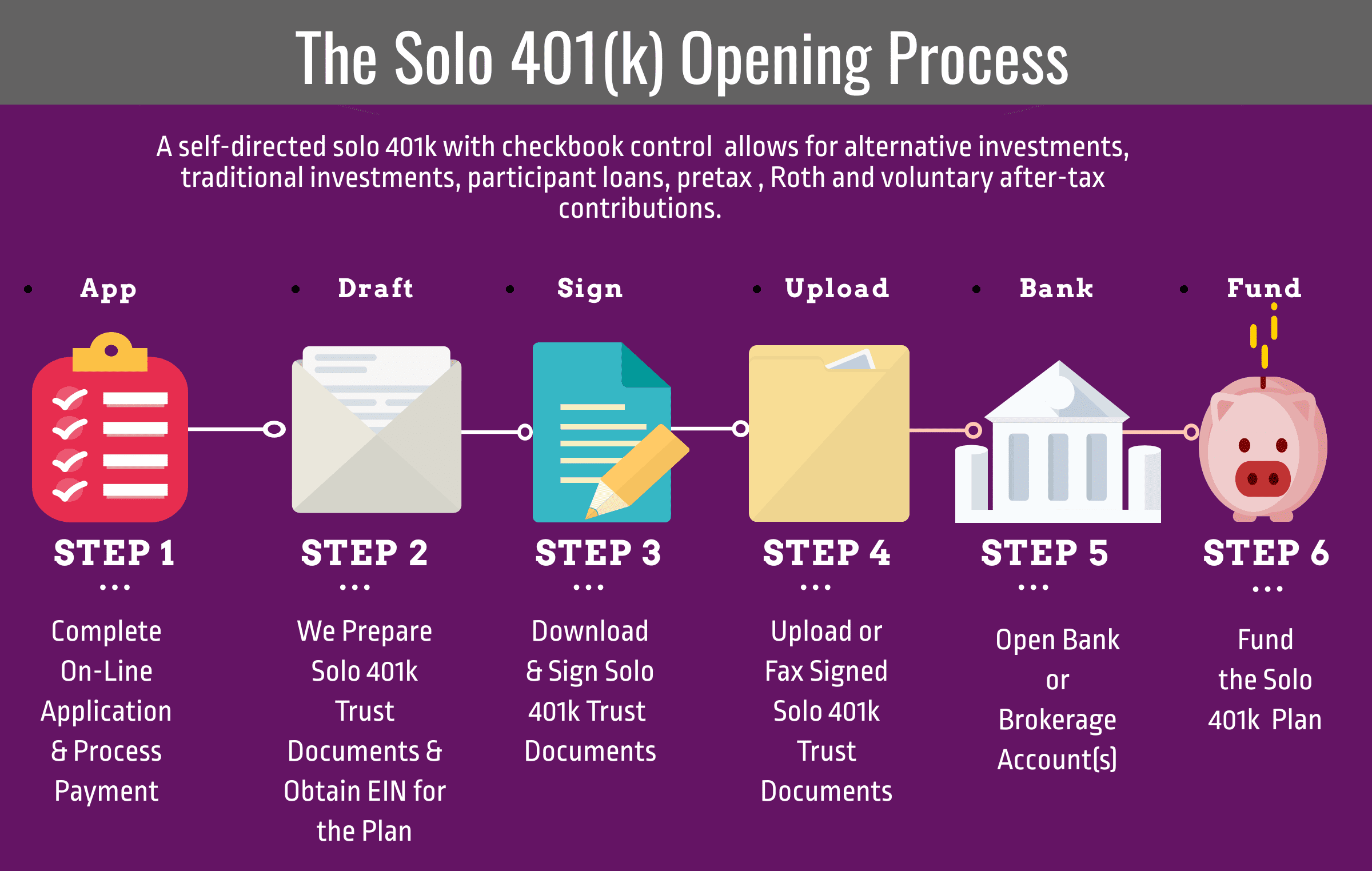

The solo 401k setup options offered by MySolo401k are complete, thorough, and easy-to-understand. From start to finish, their process looks like this:

MySolo401k has the structure perfectly aligned. Here are the steps that you will need to work through:

- You complete the on-line application.

- They process the application, gather documents, and register your EIN with the IRS.

- You download, sign, and return the documents.

- You open your brokerage or bank account using the documentation and EIN number.

- You can move forward with the account as needed!

Throughout this process, MySolo401k has systems set up to ensure that you are following all laws, getting the answers that you need, and following the right steps for your particular situation.

The plans for solo 401k’s through this site even include a brokerage account with your choice of firm, and the company will also set you up with all transfer documents that you will need to rollover former employer 401k or IRA accounts into this new solo 401k.

Once you have the ball rolling on your solo 401k plan, you will still have support from the company to ensure that you can have all of your questions answered and that you are still in compliance with all laws.

No Solo401k Limitations

Some solo 401k providers put limitations on how or where your 401k can be used. While MySolo401k will always do their best to ensure that everything is being handled legally, they do not limit the ways that your solo 401k can be used unless those limitations are written in law.

With MySolo401k, you can use it where it is legal – it can be used to invest in real estate. For landlords, this can be a big relief as some firms and account holders will set up additional limitations. Generally, these rules must be followed:

- Any real estate investment must be made in the name of the 401k.

- If managing a rental through it, everything must be done through the 401k (i.e., expensing, purchases, collecting payments).

- You cannot use the property that you invest it in personally.

- You cannot work on the property yourself; you need to call someone in to do the work if the money used to buy it came from the 401k.

There are, of course more rules and limitations. All questions can and will be answered by the team at MySolo401k as they come up.

Beyond The Solo401k

Though it is their namesake, solo 401k’s are not the only products offered at a high-quality caliber from MySolo401k.net. They also offer 401k Business Financing setups and IRA LLC setups.

401k Business Financing helps to set up a company, usually with full-time employees, with the necessary 401k documentation to be able to access no-hassle funding sources for growing or expanding your business, as is explained in more detail here.

IRA LCC, also known as a self-directed IRA, can be used to do real estate investment or for other types of investment in very specific situations, which means that there is another way for you to diversify your financial situation.

If you aren’t sure which (if any) of these types of investment financial planning is right for your current situation, don’t fret! You can find out more from the MySolo401k before committing to any type of plan, and you can make your decision from there.

They Care About Compliance

One of the greatest things about this company is that in all of their product offerings, from solo 401ks to IRA/LLC situations, they put a high priority on ensuring that everything has a legal trail of paperwork. They also ensure that the setup is legal as laws change and can check in about compliance from year-to-year if desired.

Compliance is a huge deal when you are dealing with your investments, loans, retirement, and so many other factors of the financial situation for both your personal finances and your business’s finances.

If you make a mistake that causes the IRS to fine you or request some other type of return for the problems, they could be very costly.

Using a site like MySolo401k.net that can assist you in avoiding those types of situations is ideal.

Investment Direction

Another great thing about MySolo401k is that they provide a lot of investment direction just in their base education and coaching materials on the site, and this can be very beneficial for landlords.

Understanding how you can use retirement plans like a solo401k, IRA account, or other business aspect as a loan to support the growth of your business can be overwhelming. It’s even more confusing if you have no experience with this industry.

With the help of MySolo401k, you will be able to see if you can get the loans, backing, and investments that you’ve dreamed of moving through their offered products.

Experience Counts

The biggest benefit of working with a company that works at the high-quality level that MySolo401k does is that they know how to get the job done, and they do that well. The company has tons of experience, and their reputation is good, too.

The owners are hands-on workers with decades of experience; they can provide advice, guidance, and structure that might not be found in teams with less experience. Throughout the entire process, they focus less on quickly getting your money and more on the long-term relationship.

They want you to succeed and have a legal, functioning financial setup. Their commitment to ensuring that happens can be seen even in the positive reviews that they continually receive via BBB.

While ratings aren’t everything, there is something to be said about having strong 5-star ratings in nearly all reviews of MySolo401k, and that is something worth paying attention to!

Products Available From MySolo401k

The three main services offered by MySolo401k.net are setting up the following types of business accounts or arrangements:

- 401k Business Financing: Take loans, finance certain aspects of business, and remain tax-free while using your retirement funds.

- Solo 401k: Retirement fund setup that can be used for loans, investing, and simple retirement management by business owners with no employees.

- IRA LLC: Retirement fund that can be used for loans, passive investments, and more.

Each of these products from MySolo401k has a flat fee that covers the entire set-up with no exclusions as well as the first year of management and support for whichever business plan you are setting up.

After that, there is a flat rate annual fee involved that helps to manage the plans from a support and administrative side. The full breakdown of what the annual costs go towards at this exact time can be found in the pricing details, but the fees are very reasonable for what the company does.

A Note For Landlords About Plan Types

Today, we’ve talked a lot about the different types of business options and retirement plan set-ups that MySolo401k can do, and many of those options can be used by landlords. If you aren’t savvy in the world of finances and investments, however, the best way to get involved in these areas can be confusing.

As a landlord, you need to be sure that it is legal for you to set up a solo 401k or other, related plan. Many landlords think that they are able to use a solo 401k plan but later find out that they do not qualify because they only make passive income from their properties and are not incorporated.

Additionally, you cannot have any employees while using a solo 401k, so you will need to ensure that all builders, managers, and all other service professionals used are hired as contractors.

For the solo 401k, an active role must be played, so you will need to be sure that you are responsible for property management as well as collecting rent. Thankfully, MySolo401k.net is great about helping you to be sure that you are eligible for the program before you put in the money or effort.

Once you have your accounts in action, you can easily learn how to use them for loans, set up passive investments to grow your personal financial wealth, and much more. There are dozens of ways to use these accounts, and MySolo401k has the knowledge that you need access to in order to keep expanding.

Conclusion

MySolo401k.net is a unique financial company that can help set up specific retirement account types that are used by landlords around the country. Some landlords use their offerings to set up a plan for their future while others use the same plans as a way to further invest in their business’s growth or to manage their investments in a more efficient way.

Regardless of how you plan to use this type of account, working with the reputable MySolo401k.net company is sure to provide the support that you need. Their work effort, results, and award-winning team create an atmosphere that breeds success; will it work for you?